jersey city property tax rates

The information displayed on this website is pulled from recent census reports and other public information sources. Thank you for confirming.

10 Quick Money Hacks To Boost Your Retirement Savings In 2022 In 2022 Saving For Retirement Quick Money Hacks Money Tips

By Mail - Check or money order payable to.

. By Mail - Check or money order payable to. New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes. Of this 325 million or about 47 will be funded by city property tax.

The minimum combined 2022 sales tax rate for Jersey City New Jersey is. City of Jersey City Tax Collector. The December 2020 total local sales tax rate was also 6625.

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Online Inquiry Payment. In the face of a 27 million state aid cut the BOE raised the levy only 12 millionAs a result 100 districtwide layoffs ensued.

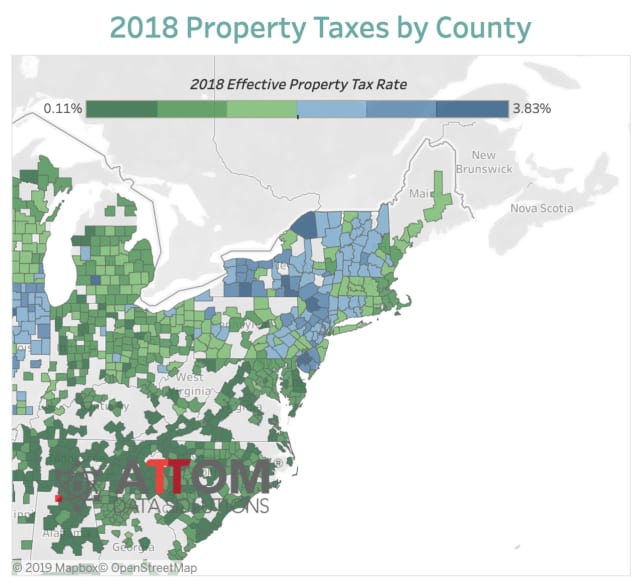

In fact rates in some areas are more than double the national average. Jersey Citys average tax rate is 167 of assessed home valuesslightly lower than the New Jersey state average of 189. General Tax Rate Average Tax Bill Average Residential Assessment.

NEW -- New Jersey Realty Transfer Fee Calculator. Camden County has the highest property. The Jersey City sales tax rate is.

The current total local sales tax rate in Jersey City NJ is 6625. The average effective property tax rate in New Jersey is 242 compared to. This rate includes any state county city and local sales taxes.

23 rows The Average Effective Property Tax Rate in NJ is 274. We had placed a call to the property tax administrator who had provided the updated rate of 161. NEW -- New Jersey Map of Median Rents by Town.

2 In 2019 Jersey Citys board of education was slow to react to the state pressure. 2021 Table of Equalized Valuations for all of New Jersey. Thus the annual estimated increase in city tax expense for a 461000 home can be computed as.

In Jersey City the average residential school tax in 2021 was. Overview of New Jersey Taxes. This was state-driven pressure to increase the school tax in Jersey City.

The General Tax Rate is used to calculate the tax assessed on a property. Jersey City establishes tax levies all within the states statutory rules. 6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 1 252 31 252 51 252 227 252 5677 252.

Visit Our Website Today. The County sales tax rate is. In Person - The Tax Collectors office is open 830 am.

In the very near future it will be over 2. It is equal to 10 per 1000 of the propertys taxable value. In the citys defense last year it offset the 993 increase in school taxes by using 69 million in federal coronavirus relief funds to lower.

Homeowners in New Jersey pay the highest property taxes of any state in the country. New Jersey Tax Court on January 31 2022 for use in Tax Year 2022. City of Jersey City.

The proposed 2022 city tax rate is thus 324M39B 082. NEW -- NJ Property Tax Calculator. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year.

The latest sales tax rate for Jersey City NJ. Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving disagreements. 280 Grove St Rm 101.

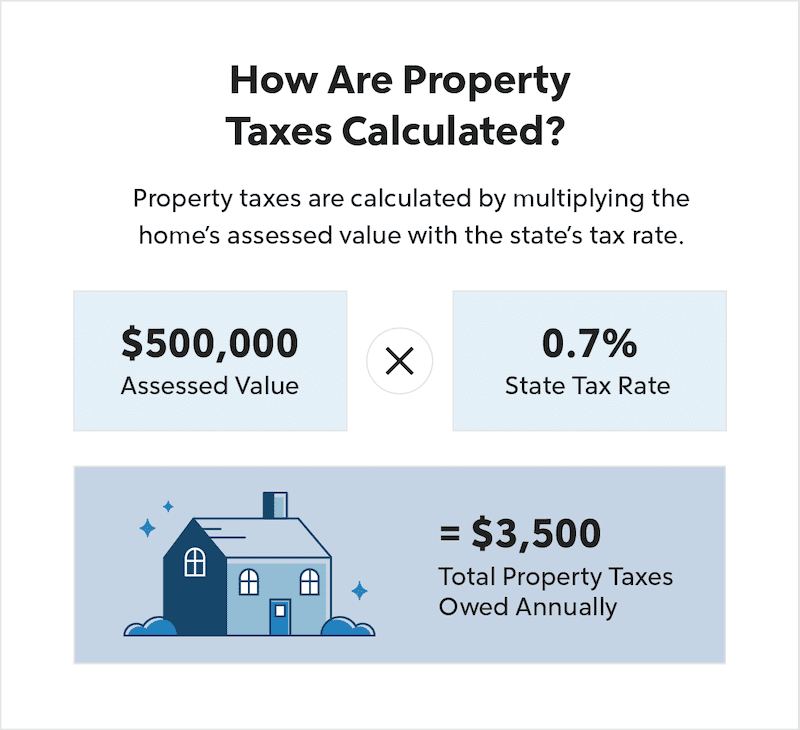

The amount of property tax owed depends on the appraised fair market. 461000 x 082 059 1060 annual increase in city tax expense. Portions of Jersey City.

Get Accurate Jersey City Records. Get driving directions to this office. HOW TO PAY PROPERTY TAXES.

2020 rates included for use while preparing your income tax deduction. 1 Since 2018 the state of NJ has reduced 155 million of education aid to Jersey City. Table of Equalized Valuations.

Certified October 1 2021 for use in Tax Year 2022 As amended by the. Per state data here the average home in Jersey City was assessed at 461000 in 2021. To pay for the City of Trenton Property taxes online you will need either your account number or the propertys block lot and Qualification if applicable and the owners last name.

NEW -- Historical New Jersey Property Tax Rates. 201 547 5132 Phone 201 547 4949 Fax The City of Jersey City Tax Assessors Office is located in Jersey City New Jersey. Visit Our Website For Trustable Records.

The city of Jersey Village is looking to adopt a lower property tax rate for the 2020-21 fiscal year but one that will. This is the total of state county and city sales tax rates. The 148 number is from 2018 and even Jersey Citys own website hasnt been updated to reflect the change.

Jersey City New Jersey 07302. While Jersey City has the lowest property tax rate in Hudson County with a General Tax Rate of 161. Select the Icons below to view the assessments in Adobe Acrobat or Microsoft Excel.

Ad Find All The Tax Records You Need In One Place. Did South Dakota v. Tax amount varies by county.

Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST. The New Jersey sales tax rate is currently. Real estate evaluations are undertaken by the county.

Across the state the average homeowner pays 4908 a year in school taxes roughly half of the average property tax bill of 9284. Based on this rate and average market conditions you can expect to pay 6426 in annual property taxes.

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

State Local Property Tax Collections Per Capita Tax Foundation

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Property Tax Abatements How Do They Work

Real Estate Taxes Vs Property Taxes Quicken Loans

These Hudson Valley Counties Have Highest Property Tax Rates In Nation New Study Says Ramapo Daily Voice

Monday Map State Local Property Tax Collections Per Capita Tax Foundation

States With The Highest And Lowest Property Taxes

2022 Property Taxes By State Report Propertyshark

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

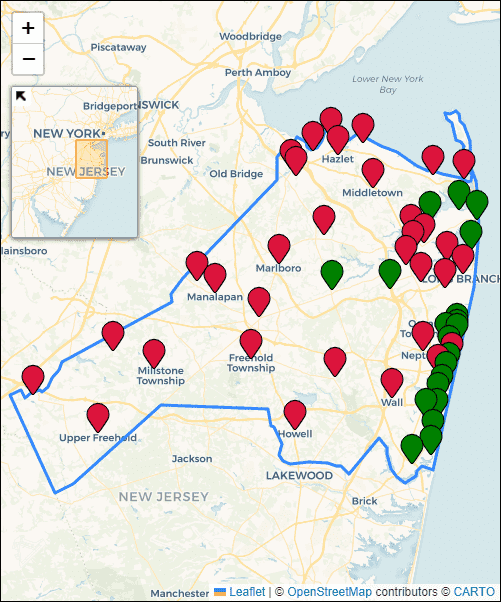

Property Tax Rates Average Tax Bills And Home Assessments For Monmouth County New Jersey

Thinking About Moving These States Have The Lowest Property Taxes

Nyc Home Prices Plunge After Salt Deductions Capped

Map State Sales Taxes And Clothing Exemptions Tax Foundation

Pursuing A Property Tax Appeal In New Jersey Sharlin Law

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities